Robo Advisors: Are They Truly Tailored to Millennials’ Investing Preferences?

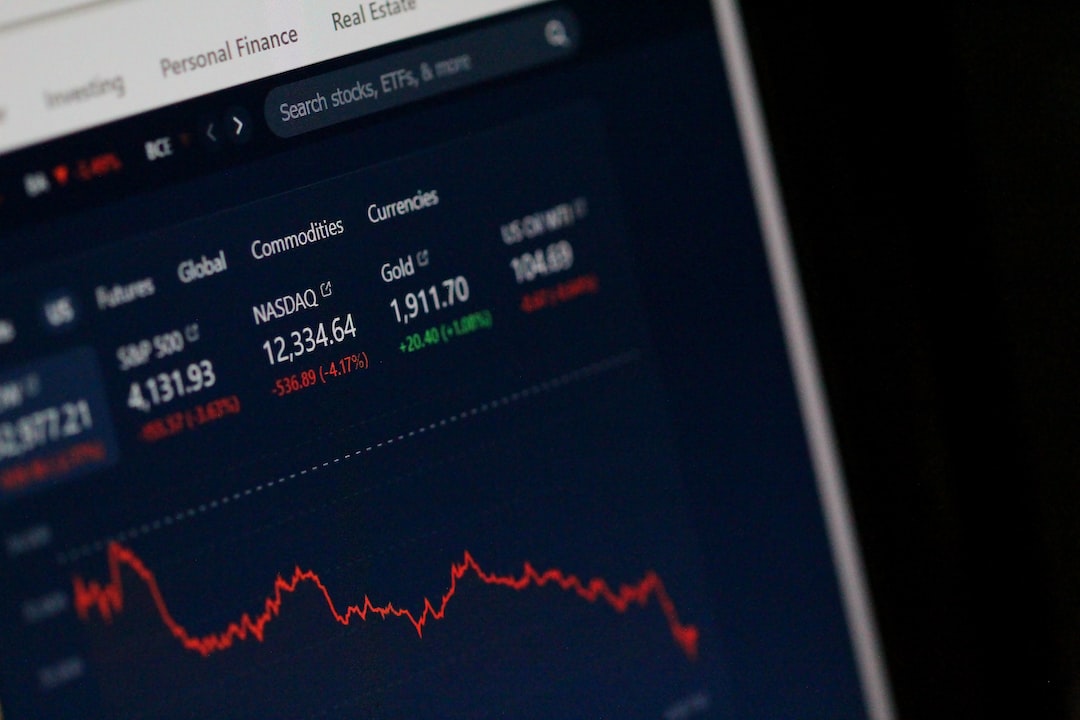

Millennials, born between 1981 and 1996, are often associated with digital technology, convenience, and efficiency. This generation, raised in the era of rapid technological advancements, has embraced the digital age in almost every aspect of their lives. When it comes to managing their finances, millennials are no exception. This has led to the rise of robo advisors, automated investment platforms that promise to revolutionize the way individuals invest their money. However, the question remains: are these robo advisors truly tailored to millennials’ investing preferences?

To answer this question, a robo advisor comparison is necessary. Robo advisors, such as Betterment, Wealthfront, and Robinhood, have gained traction in the investment market due to their simplicity, low fees, and user-friendly interfaces. These platforms use algorithms and advanced technology to create diversified investment portfolios for their users. Millennials, who value convenience and cost-effectiveness, have been naturally drawn to this new way of investing.

One of the key advantages of robo advisors is their accessibility. Unlike traditional financial advisors who often require large minimum investments, robo advisors have low or even no minimum balance requirements. This allows millennials with limited funds to invest and grow their wealth. Additionally, robo advisors offer 24/7 availability, enabling users to manage their investments at their own convenience. With the majority of millennials being tech-savvy and constantly connected to their smartphones, this accessibility aligns perfectly with their lifestyle.

Another aspect that appeals to millennials is the transparent fee structure of robo advisors. Unlike traditional financial advisors who may charge high management fees, robo advisors typically charge lower fees, making investing more affordable for millennials. Moreover, most robo advisors provide clear breakdowns of their fees, allowing users to have a better understanding of the costs involved. This transparency resonates with millennials, who prioritize financial literacy and want to avoid hidden charges or unnecessary expenses.

However, despite these advantages, it is important to note that robo advisors might not fully meet all of millennials’ investing preferences. While robo advisors offer diversified portfolios, some millennials may prefer a more customized investment strategy that aligns with their values or interests. Furthermore, the absence of a human touch may deter individuals who seek personalized advice or guidance when it comes to financial matters.

In conclusion, robo advisors have undoubtedly revolutionized the investment landscape and have become popular among millennials due to their accessibility, low fees, and transparency. However, a robo advisor comparison reveals that while these platforms cater to some of millennials’ investing preferences, they may not fully meet all of their unique needs. It is essential for millennials to carefully assess their investment goals, desired level of involvement, and the importance of personalized guidance before choosing a robo advisor or exploring other investment options.

************

Want to get more details?

Skeptical Millennial

https://www.skepticalmillennial.com/

Unlocking the secrets to millennial moolah magic! Join our money-savvy journey in the world of Personal Finance and Investing