The evolving role of hedge fund lawyers in the era of digital transformation

In the fast-paced world of finance, constant innovation and technological advancement are leading to a digital transformation across industries. As hedge funds strive to stay ahead and remain competitive, their legal advisors, commonly known as hedge fund lawyers, are playing an increasingly crucial role in this ever-changing landscape.

The role of hedge fund lawyers has traditionally involved navigating complex legal frameworks, offering advice on regulatory compliance, and ensuring transactions are conducted in accordance with legal requirements. However, the rise of digital transformation has introduced new challenges and opportunities, thus expanding the scope of their role.

One of the key areas in which hedge fund lawyers are faced with new demands is in the realm of data privacy and cybersecurity. With the increased reliance on technology and massive amounts of data being generated, hedge funds must prioritize the protection of sensitive information. Hedge fund lawyers are partnering closely with IT and cybersecurity experts to design robust information security policies, draft data protection agreements, and implement measures to minimize cyber threats. Their expertise in assessing cybersecurity risks and developing mitigation strategies ensures that hedge funds are adequately protected in the digital era.

Furthermore, the advent of cutting-edge technologies, such as artificial intelligence (AI), machine learning, and blockchain, has sparked a wave of innovation in the financial sector. Hedge fund lawyers need to be well-versed in the legal and regulatory aspects surrounding these technologies to help their clients seize opportunities and navigate potential pitfalls. Whether it involves drafting smart contracts on blockchain platforms or addressing legal dilemmas arising from the use of AI algorithms for investment decisions, hedge fund lawyers must be adaptive and possess a deep understanding of these emerging technologies.

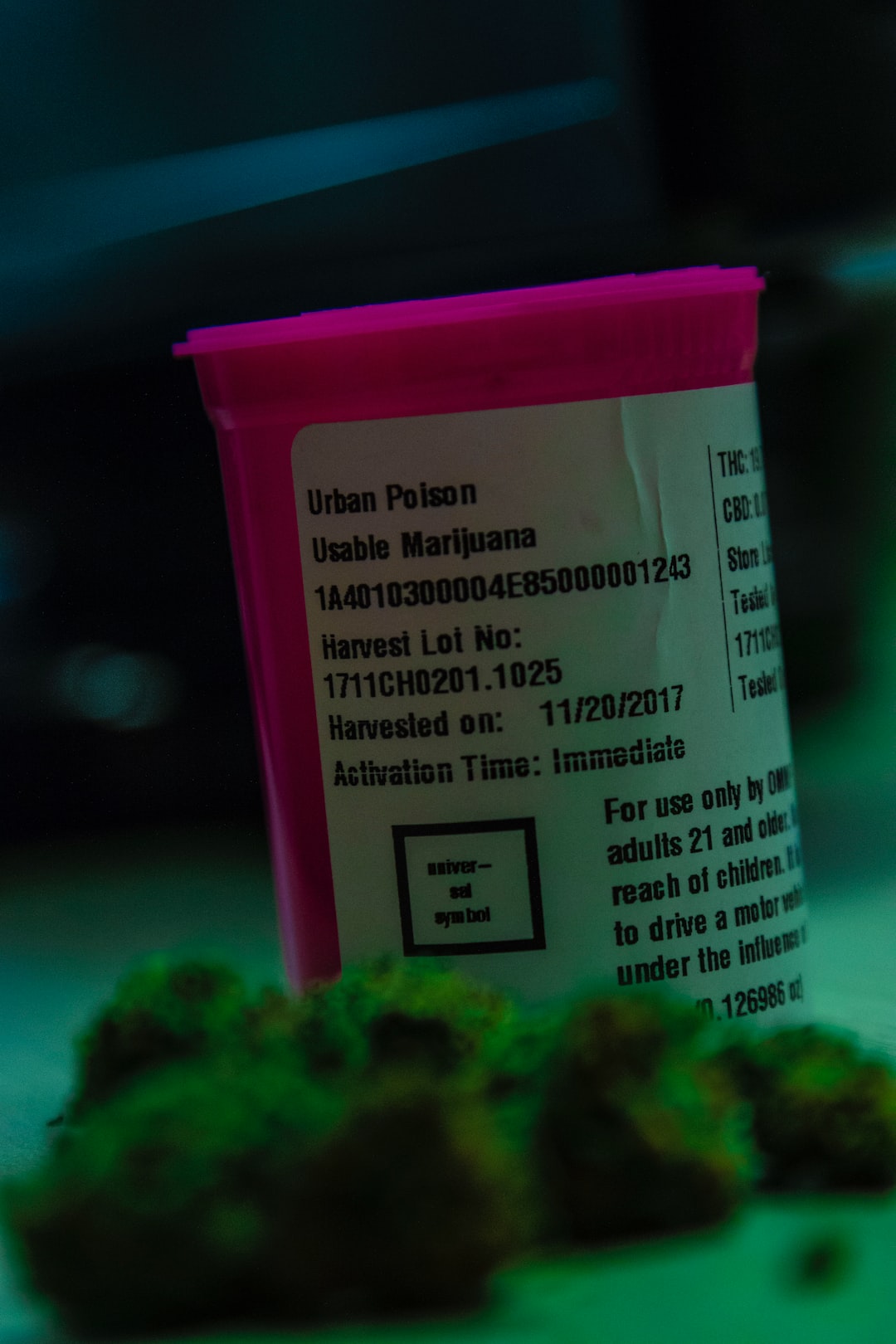

Additionally, digital transformation has revolutionized the way financial transactions are conducted. With the emergence of cryptocurrencies and digital assets, hedge fund lawyers must comprehend the intricacies of these new financial instruments and provide clarity regarding the regulatory landscape. They assist in designing compliant investment strategies, drafting crypto-related contracts, and advising on how to approach legal challenges in the digital asset space.

As the role of hedge fund lawyers evolves, their responsibilities now extend beyond solely offering legal advice. They are increasingly involved in strategic decision-making, working closely with fund managers, compliance teams, and technology experts to ensure the firm stays ahead of regulatory changes and technological disruptions.

In conclusion, the digital transformation revolutionizing the financial industry has significantly impacted the role of hedge fund lawyers. Beyond their traditional legal expertise, they now play a pivotal role in areas of data privacy and cybersecurity, emerging technologies, and the regulatory aspects of digital assets. In the era of digital transformation, hedge fund lawyers serve as essential partners, helping hedge funds adapt to change, seize opportunities, and mitigate risks in this rapidly evolving financial landscape.

Publisher Details:

Hedge Fund Law Firm | CBIG Law | Washington, DC

https://www.cbiglaw.com/

Discover the power of top-tier legal services with cbiglaw.com – where experience, expertise, and dedication meet to deliver exceptional results for out clients. Unleash the full potential of your investment strategies combined with legal intelligence with our team of accomplished attorneys to form legally compliant vehicles that are ready to accept capital from potential investors. Get ready to redefine your idea of excellence with cbiglaw.com!